Deductibles

A deductible is the amount you pay each year under your group health insurance plan for eligible health care services and/or prescriptions before your insurance carrier begins to share the expense of covered services under the plan.

As an example, if you have a $1,500 deductible, you will pay the first $1,500 of the total eligible health care expenses prior to your health plan begins to pay.

Medical expenses that normally are applied to the deductible include hospitalization, surgery, lab work, testing procedures, anesthesia, and certain medical devices. Expenses not covered by the deductible include copay’s insurance premiums and expenses deemed ineligible under the group health insurance plan.

Group health insurance plans often have separate deductibles for an individual and a family. They will often have a maximum of two or three deductibles per family. Finally, plans will often have separate deductibles for in-network versus out-of-network hospitals, health care facilities and physicians.

If you are in good health and don’t anticipate incurring expensive medical costs during the coming year, a plan that has a high deductible and a lower premium might be a good option for you. However, if you have a health condition or you have a family with an active lifestyle, a plan with a lower deductible and higher premium might be a better choice for you.

Your group health insurance plan probably has a combination of deductibles and copay’s. If your plan does have copay’s, then you simply pay the copay amount at the time a covered service is rendered – either in a physician’s office, emergency room or at a pharmacy. It depends on your health plan as to whether your copay’s apply towards your deductible.

Finally, many insurance companies will pay for some covered services, like preventative or disease management before you’ve met your deductible.

Copay's

A copay is a set charge paid by an insured individual when visiting their physician or specialist, an urgent care or the emergency room, or when filling or refilling a prescription. The amount of the Physician’s Office Visit Copay varies by carrier and plan, but your copay can increase significantly for HMO and PPO plans. Also, in most cases, copay’s do not apply when going outside of your provider network – rather services are subject to deductible and coinsurance.

Prior to so-called “health care reform,” many insurance carriers allowed employees to choose their physician freely. As health care costs have risen, due in part to government mandates, insurance plans began managing costs and the care associated with those costs. They entered into managed competition – or managed care – contracts with physicians, physician practices, hospitals and other health care facilities that offer lower reimbursement rates, in exchange for patients being funneled to those physicians via the insurance carrier’s in-network provider list. This also allows the Insurer use share the costs with insured employees and their families, and realize lower costs overall.

Copay’s can be complicated. That is why you have an employee benefit broker. Copay’s are fees charged each time you visit a health care provider, and these fees vary. You pay one copay to visit a General Practitioner, a higher one to visit a specialist and a different copay for an emergency room. There are also copay’s for tests, prescriptions, physical therapy, etc.

Total copay costs can be significant for those with emergencies or chronic conditions However, there are usually limits on total copay costs – most health care plans have annual and lifetime caps on out-of-pocket costs. These maximum costs are spelled out in the contract and the supporting brochures. There are some exemptions requiring insurers to offer preventative care without copay’s, which might include some combination of annual checkups, immunizations, and some diagnostic exams.

Different insurance plans treat copay’s and deductibles differently. Some may apply deductibles and copay’s toward the maximum annual out-of-pocket, while others will only apply deductibles or, perhaps, only certain copay’s, but not others. This, too, will be spelled out in the contract and supporting material.

Copays rangefrom:

– Physician’s Office Visits $15 to $35;

– Specialists $30-$50;

– Urgent care $75 – $200; and

– Emergency Room, $200-$500.

Copay’s for prescriptions differ based on medication type, whether it is a brand name or generic, and based on the insurance plan’s formulary.

Copay’s are a significant part of the healthcare financing system. However, their significance is shrinking somewhat as overall health care costs have been increasing. historically, deductibles rose from an average $303 a year in 2006 to $1,200 a year in 2016. Enrollee spending on deductibles rose from $151 to $417 during the period, a 176% increase. However, total copay’s actually fell 38%, from $225 in 2006 to $140 in 2016.

Coinsurance

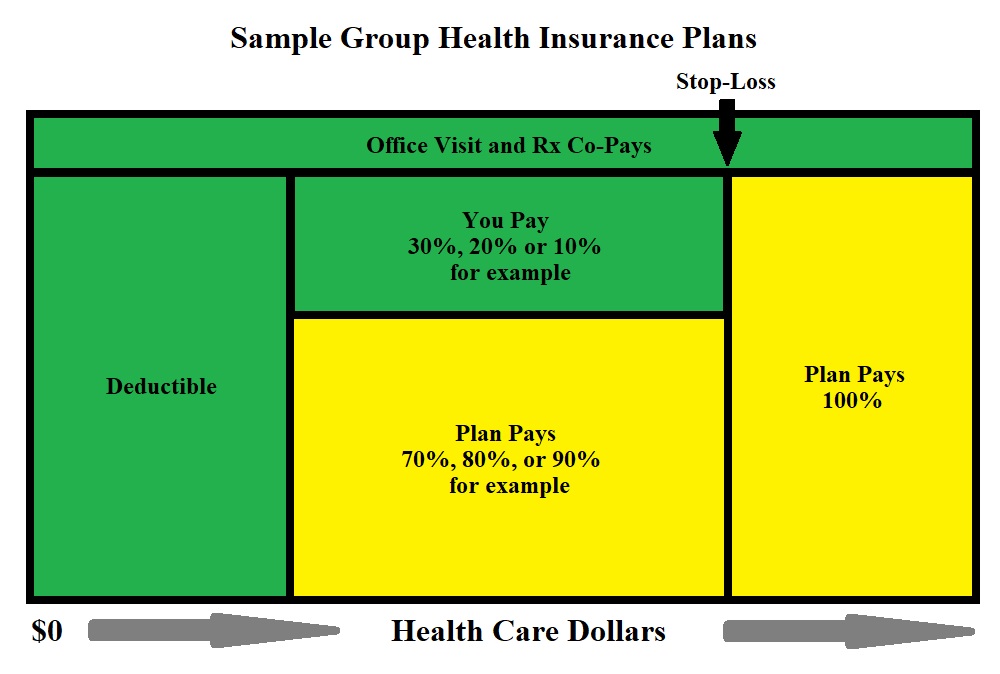

Coinsurance is most often a fixed percentage of the costs of covered services through a health care plan after you have paid your “Deductible.” A common coinsurance breakdown is an 80/20 split – the health plan paying 80% and the insured paying their 20%.

If, for instance, you have already met your deductible, and you visit your physician’s office – incurring a charge of $450. Your health insurance plan – via its managed care agreement – will allow $250 with the remaining amount written off by the provider as part of their agreement. Of that amount, your coinsurance is 20% or $50, and your health plan pays the balance.

As a generalization, health care plans with lower monthly premiums, have higher coinsurance percentages, and conversely higher monthly premiums might have lower coinsurance percentages.

Unlike copay’s, coinsurance amounts paid towards incurred expenses apply towards “Maximum-Out-of-Pocket” limits. Should you require an additional procedure or service later in the year, the deductible having been satisfied, you will still incur your coinsurance percentage – until the stop-loss limit has been reached. Once the stop-loss maximum limit has been reached for the year, the plan will begin to pay 100% of covered expenses.

Out-of-Pocket Maximums

An “Out-of-Pocket Maximum” is a limit or cap on the amount of money you will have to pay for covered health care services through your group health insurance plan. Once that limit is met, your health care plan will pay 100% of remaining expenses for the remainder of the plan year. The plan year is defined in the group health insurance policy.

Expenses you pay for covered services are attributed towards your out-of-pocket maximum include deductible, coinsurance, and possibly copay’s you owe for physicians services. Copay’s for prescription drug costs might also count towards the out-of-pocket maximums in certain cases with certain plans.

Covered employees with dependents, will not only have individual out-of-pocket maximums, but will also have family out-of-pocket maximums. These maximums might be expressed as a multiple of two or three individual out-of-pocket maximums, or might also be expressed as a set dollar amount.

As already mentioned, certain covered health care expenses count towards maximum out-of-pocket limits. However, there are also certain expenses which do NOT count towards these limits. These might include services that are simply not covered, expenses in excess of allowable amounts, out of network expenses, premiums paid for coverage, preventative care already covered at 100%, and in very rare cases deductibles under the plan. All of this is outlined in the group health insurance policy contract.

Pharmacy Copay's

Pharmacy copay’s have become much more complicated in the last decade especially. Once it was a simple proposition of there being a single copay for brand name drugs and a lessor one for generic drugs. However, the push for cost containment has brought on an increasing number and complexity to cost-sharing in prescription drug benefits.

More about “Pharmacy Benefits” are discussed below, but here we will briefly address very generally what one can expect from prescription drug copay’s. More and more, prescription drug benefits are being separated by “Tiers” – designed to separate various medications by their brand name versus generic status, but also to further break them down by preferred, non-preferred, so-called “Lifestyle Drugs,” and specialty drugs like biologic’s.

Generally, various tiers can be broadly described in the following categories:

Generic – are medications that are no longer protected by patents and can be produced or distributed by multiple drug manufacturers – driving the cost down significantly.

Preferred Brand Name – are brand name drugs that do NOT have generic substitute – making them more expensive, but leaving the insured / patient little choice other than the prescribed and preferred medication.

Non-Preferred Brand Name – are, in contrast, brand name drugs which DO have a generic substitute. As such, the group health plan wishes to provide a strong incentive to the insured / patient to use the generic – incurring the significant cost savings.

Fourth Tier, lifestyle or biologic’s – so-called “Fourth Tiered” medications are often set aside in their own category to separate “lifestyle” drugs being defined as drugs that treat conditions associated with lifestyle – weight loss, smoking, impotence, baldness, aging, and medications that improve cognitive function.

Specialty Drugs – are medications such as biologic’s that might be used to treat chronic conditions like blood disorders, arthritis or cancer. These drugs often require special handling and administration, such as infusion or injection.

Copay’s are divided into “Generic/Preferred/Non-Preferred/Fourth Tier/Specialty” or some variation. Copay amounts are generally expressed:

- Generic – $10

- Preferred Brand Name – $25

- Non-Preferred Brand Name – $45

- Fourth Tier, lifestyle or biologic – $60

- Specialty Drugs – $75